How To Make Money In Mining Industry

Introduction to the Mining Industry

The mining industry is involved in the extraction of precious minerals and other geological materials. The extracted materials are transformed into a mineralized form that serves an economic benefit to the prospector or miner. Typical activities in the mining industry include metals production, metals investing, and metals trading.

Types of Mining Industry Assets

Mining assets Types of Assets Common types of assets include current, non-current, physical, intangible, operating, and non-operating. Correctly identifying and can be divided into two main categories: projects and operating mines.

1. Projects

Projects in the mining industry can be broken down into the exploration and feasibility stage, and the planning and construction phase.

- Exploration and Feasibility

The purpose of exploration is to find ores that are economically viable to mine. It begins with locating mineral anomalies, after which discovering and sampling confirms or denies that there is a find. It can be further proven through drilling programs and resource definition.

- Planning and Construction

Once a potential mine is proven to be viable, the planning and construction phase begins with applying for and obtaining permits, continuing economic studies, and refining mine plans. Infrastructure development also takes place at this stage as mines are often located in remote areas that require construction of roads and electricity.

2. Operating Mines

Once the operation is ready to begin, the asset officially becomes an operating mine. During this phase, the ore is extracted, processed, and refined to produce metal. This section forms the bulk of the focus of the financial model for an operating mine. Once all the ore has been extracted, the mine closure process begins, which can last for several years. The process includes clean-up, reclamation, and environmental monitoring.

Mining Industry Reserves and Resources

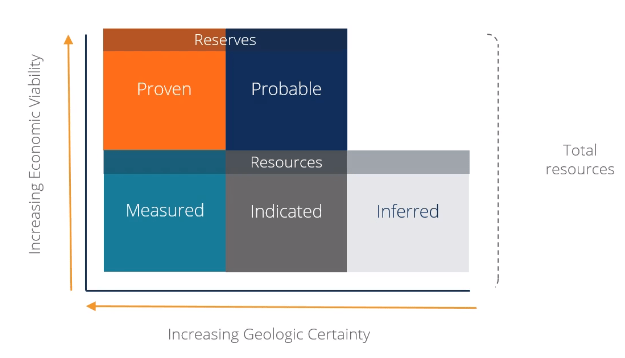

A mining company's main assets are its reserves and resources, which are the ores that contain economic materials that are viable to mine. It is important to be able to read a reserve and resource statement and understand what information needs to be pulled from it to make the financial model. The table below contains information used to produce the annual cash flow that we build up in the financial model.

If you look at the table from right to left, you are moving in increasing geologic certainty, meaning that geologists are becoming more confident about the amount of material that is contained in the ground. Moving from the bottom to top, you are increasing the economic viability, meaning that the ore at the top is more economically attractive to mine than the ore at the bottom.

In conclusion, the inferred resource is the least geologically certain and the least economically viable to mine, while the proven resource is the most geologically certain and the most economically viable to mine.

As we build a financial model, it is important to think about which part of the table we are pulling information from. We should risk-adjust the different components of the table to reflect the risks associated with them. Typically, an inferred resource will be excluded from the economic model due to the high degree of uncertainty associated with it.

The summation of the entire table is referred to as the company's total resources.

Key Terms to Know

Here are some key terms and definitions you should know before building a mining financial model:

- Ore: Rock containing metal that is economic to mine (measured in metric tons)

- Grade: The amount of metal contained per unit of ore (grams/ton or %)

- Recovery: The percentage of metal that is recoverable from ore after the extraction process (%)

- Production: The amount of metal produced (oz/year)

- Payability: Based on smelter terms, refers to the amount of money that is paid or the percentage of the metal that is paid full price for

- Cash costs: Mine site operating costs include mining, milling, labor, energy, and consumables (measured in cost per ton of material)

- All-in sustaining costs: Mine site costs + corporate G&A + sustaining capital to maintain the mine + capitalized exploration to continue to explore for reserves and resources (exclude interest or taxes)

Key Financial Concepts in the Mining Industry

- Revenue Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms "sales" and : Ore (tons) x Grade (g/t) x Recovery x Payability x Metal Price

- Royalties: Properties often have royalties on them (e.g., 2% Net Smelter Return)

- Operating costs: Per ton basis (e.g., $2.50/ton for mining)

- Capital costs Cost of Capital Cost of capital is the minimum rate of return that a business must earn before generating value. Before a business can turn a profit, it must at least generate sufficient income to cover the cost of funding its operation. : Includes initial capital (construction of mine) and sustaining capital (ongoing equipment, etc.)

- Reclamation costs: Takes place at the end of a mine's life; accrued for accounting purposes but not accrued in a cash flow model

- Depreciation Depreciation Expense When a long-term asset is purchased, it should be capitalized instead of being expensed in the accounting period it is purchased in. : A percentage of production bases over the entire life of the mine

- Taxes: Can often be complicated with mining companies operating in several countries; mining specific taxes and royalty agreements need to be considered

- Changes in working capital: Changes in accounts receivable, inventory, and accounts payable should be factored into a cash flow model

Mining Financial Model & Valuation

Learn more about the mining industry and how to value a producing asset in CFI's Mining Financial Modeling & Valuation Course.

More Resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional resources below will be useful:

- Valuation Methods Valuation Methods When valuing a company as a going concern there are three main valuation methods used: DCF analysis, comparable companies, and precedent transactions

- Mining Asset Valuation Techniques Mining Asset Valuation Techniques The main mining valuation methods in the industry include price to net asset value P/NAV, price to cash flow P/CF, total acquisition cost TAC

- Private Company Valuation Private Company Valuation 3 techniques for Private Company Valuation - learn how to value a business even if it's private and with limited information. This guide provides examples including comparable company analysis, discounted cash flow analysis, and the first Chicago method. Learn how professionals value a business

- Full Mining Valuation & Financial Model Course

How To Make Money In Mining Industry

Source: https://corporatefinanceinstitute.com/resources/careers/jobs/introduction-to-the-mining-industry/

Posted by: stonemanoundiciat.blogspot.com

0 Response to "How To Make Money In Mining Industry"

Post a Comment